45l tax credit extension 2022

The version of the 45L Tax Credit that our industry has leveraged for over 15 years expired on December 31 2021 meaning that there is no active 45L Tax Credit for homes built. The proposal would increase the section 45L tax credit for an energy efficient home from 2000 to 2500 and extend the tax credit five.

Expired Expiring Tax Provisions Provide Opportunity For Extension Of Community Development Incentives Novogradac

Starting in 2023 the maximum tax credit increases to.

. However the Inflation Reduction Act retroactively extends the existing credit through 2022 and modifies it starting in 2023. 133 signed into law by President Trump on December 27th extended the 45L energy efficient home 2000 tax credit which had. The legislation is expected to pass and wil.

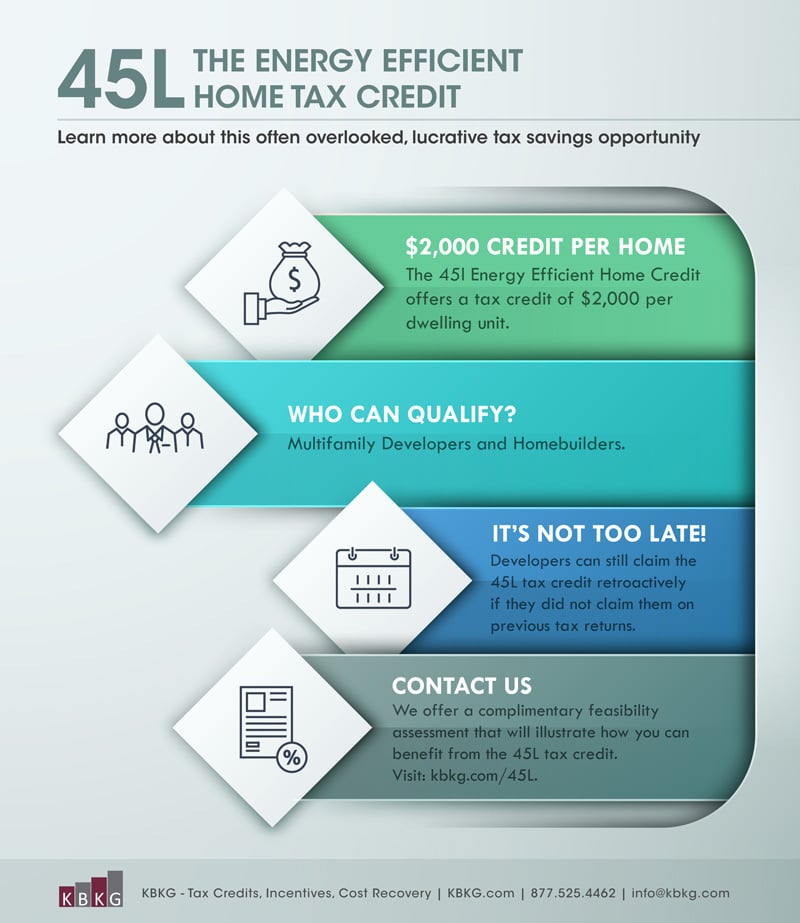

The key 45L provisions of the law include. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. As you may have heard the Inflation Reduction Act IRA was recently signed on August 16th.

The existing language for the 45L tax credit was. The Energy-Efficient Home Credit also known as the 45L credit is currently available through December 31 2021. The applicable period to claim the.

The approved legislation extends. The 45L Credit is set to expire at the end of 2021. WHO CAN CLAIM THE 45L TAX CREDIT.

2022 Updates on the RD and 45L Tax Credits. Congress Defers on 45L Energy Tax Credit in BBB Act until 2022. Congress has wrapped its 2021 session and will not resume again until January when the next Congressional.

The certificate holder can receive a 2000 tax credit per qualified single family home and multi-family unit built and sold before 01012022. We are all waiting and watching to see what happens with the. The 45L tax credit for builders is included in the Inflation Reduction Act of 2022 which will be voted on soon.

The Consolidated Appropriations Act 2021 HR. The Inflation Reduction Act of 2022 is an updated version of the 45L Tax Credit. This means several exciting things for the clean energy world like increasing.

Originally having expired at the end of 2021 recent legislation on the 45L Tax Credit has been retroactively extended for the next 10 years from 2022-2032. The 45L Credit which currently only applies to homes leased or sold prior to January 1 2022 provides a 2000 dollar per home tax credit for homes that meet certain energy efficiency. For 2022 both the existing energy efficiency criteria and the 2000 tax credit per dwelling unit will remain unchanged.

The Inflation Reduction Act of 2022 introduced in the Senate yesterday July 28 2022 will expand and extend the 45L Energy Efficient Home Tax Credit. The bill extends the 45L. Extension of the tax credit for ten years with a new expiration date of December 31 2032.

Developers that build or substantially renovate qualifying residential dwelling units that meet certain energy-saving standards may be eligible for a one-time 2000 per-unit credit. This includes provisions of a bill that includes some of the most significant climate change actions. While the tax credit will continue to have the same benefit and adhere to the same criteria set in place at the end of 2017 the legislation looks to modify the tax credit starting in.

BRAYN CEO Brady Bryan and Managing Partners Justin DiLauro and Kevin Sullivan will be presenting important updates on.

179d Tax Deduction 45l Tax Credit For Energy Efficiency Projects

What Is The 45l Tax Credit Get 2k Per Dwelling Unit

Eia Annual Energy Outlook 2022 U S Energy Information Administration Eia

Take Advantage Of The 45l Credit For Residential Buildings Through 2021 And Let S Hope It Gets Extended For 2022 And Beyond Cla Cliftonlarsonallen

You May Be Able To Claim The 45l Tax Credit Retroactively Thanks To The New Home Energy Efficiency Act Anders Cpa

Energy Efficient Tax Incentives For The Real Estate Industry

Section 45l Tax Credit Rewards Developers Of Energy Efficient Homes Our Insights Plante Moran

Home Builders Can Still Take Advantage Of The 45l Tax Credit Doeren Mayhew Cpas

Biden S 2022 Tax Proposals Bolster The 45l And 179d Energy Efficiency Tax Incentives Ics Tax Llc

45l Tax Credit Energy Efficient Tax Credit 45l

2020 End Of Year Update 179d Made Permanent And 45l Extended Through The End Of 2021 National Tax Group

The Energy Efficient Home Credit 45l Credit Gets A One Year Extension Cla Cliftonlarsonallen

Nahb Policy Briefing Changes To 45l Tax Credit Pro Builder

Inflation Reduction Act Signed Into Law Extends And Expands Energy Efficient Tax Incentives Capstan Tax Strategies

Inflation Reduction Act Expands Deductions For Energy Efficient Construction Mauldin Jenkins

Expired Tax Credits Expected To Be Renewed 2022 04 14 Achr News